The Only Guide for Hsmb Advisory Llc

The Only Guide for Hsmb Advisory Llc

Blog Article

4 Easy Facts About Hsmb Advisory Llc Described

Table of ContentsTop Guidelines Of Hsmb Advisory LlcIndicators on Hsmb Advisory Llc You Should KnowThe Hsmb Advisory Llc PDFsThe Basic Principles Of Hsmb Advisory Llc Top Guidelines Of Hsmb Advisory LlcFacts About Hsmb Advisory Llc Revealed

Ford says to steer clear of "cash money value or irreversible" life insurance policy, which is more of a financial investment than an insurance coverage. "Those are very made complex, come with high commissions, and 9 out of 10 people don't need them. They're oversold since insurance coverage agents make the biggest commissions on these," he states.

Handicap insurance can be costly. And for those that choose for long-term treatment insurance policy, this policy might make impairment insurance policy unnecessary.

About Hsmb Advisory Llc

If you have a chronic health worry, this type of insurance could end up being critical (St Petersburg, FL Health Insurance). Nonetheless, do not allow it emphasize you or your bank account early in lifeit's typically best to get a plan in your 50s or 60s with the anticipation that you will not be using it until your 70s or later.

If you're a small-business proprietor, take into consideration shielding your resources by acquiring business insurance. In the event of a disaster-related closure or period of restoring, organization insurance policy can cover your income loss. Consider if a significant weather event influenced your storefront or manufacturing facilityhow would certainly that affect your income? And for just how long? According to a report by FEMA, in between 4060% of little organizations never ever reopen their doors complying with a disaster.

And also, utilizing insurance can occasionally cost even more than it saves in the long run. If you get a chip in your windshield, you might consider covering the fixing expenditure with your emergency financial savings instead of your auto insurance. Insurance Advisors.

A Biased View of Hsmb Advisory Llc

Share these tips to secure liked ones from being both underinsured and overinsuredand seek advice from a relied on professional when required. (https://my-store-f53c39.creator-spring.com/)

Insurance policy that is purchased by an individual for single-person insurance coverage or coverage of a household. The individual pays the premium, as opposed to employer-based wellness insurance policy where the employer often pays a share of the premium. Individuals might buy and acquisition insurance policy from any strategies offered in the individual's geographical area.

Individuals and households might get approved for financial aid to lower the cost of link insurance policy costs and out-of-pocket costs, but only when enlisting through Connect for Wellness Colorado. If you experience particular changes in your life,, you are qualified for a 60-day amount of time where you can sign up in an individual plan, also if it is beyond the yearly open registration period of Nov.

Hsmb Advisory Llc Things To Know Before You Buy

- Connect for Health Colorado has a full list of these Qualifying Life Occasions. Reliant kids who are under age 26 are eligible to be included as family participants under a moms and dad's protection.

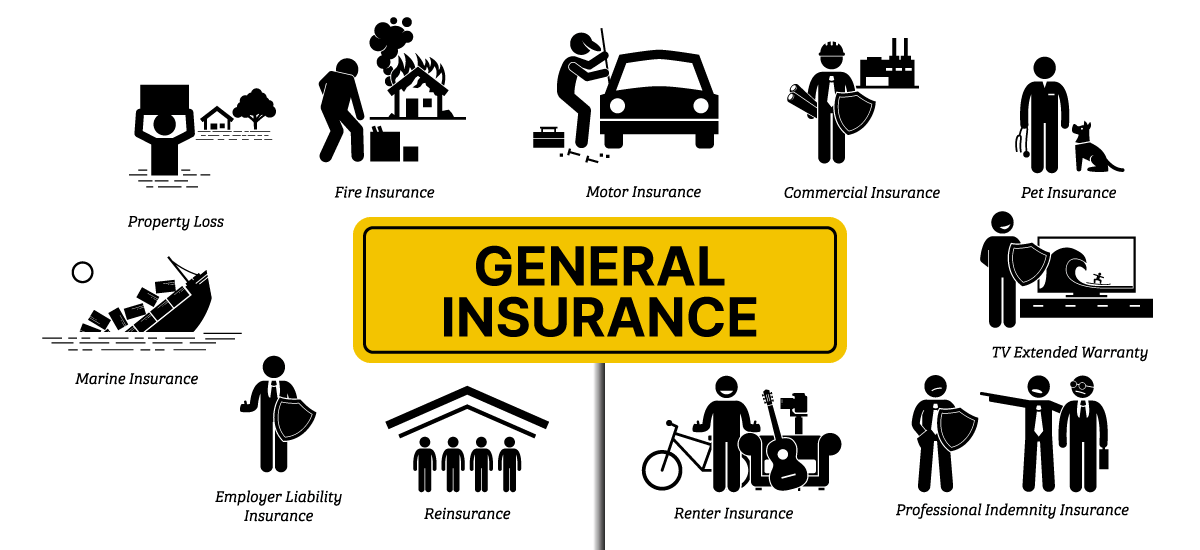

It might seem easy but understanding insurance policy types can additionally be perplexing. Much of this complication comes from the insurance coverage industry's continuous goal to design customized insurance coverage for policyholders. In designing adaptable plans, there are a range to choose fromand every one of those insurance policy kinds can make it challenging to recognize what a details policy is and does.Little Known Questions About Hsmb Advisory Llc.

If you pass away throughout this duration, the individual or individuals you have actually called as beneficiaries might get the money payment of the plan.

Nevertheless, many term life insurance policy policies let you convert them to an entire life insurance policy plan, so you don't lose coverage. Usually, term life insurance coverage plan costs settlements (what you pay per month or year into your policy) are not secured at the time of purchase, so every five or ten years you have the policy, your premiums can climb.

They likewise have a tendency to be less expensive general than entire life, unless you buy a whole life insurance policy when you're young. There are likewise a few variations on term life insurance policy. One, called team term life insurance policy, is usual amongst insurance coverage choices you may have access to with your employer.Hsmb Advisory Llc Can Be Fun For Anyone

This is typically done at no cost to the staff member, with the ability to purchase added insurance coverage that's secured of the worker's paycheck. An additional variant that you may have accessibility to via your employer is supplemental life insurance policy (St Petersburg, FL Health Insurance). Supplemental life insurance policy could consist of unintended death and dismemberment (AD&D) insurance policy, or burial insuranceadditional coverage that might help your household in case something unanticipated happens to you.

Irreversible life insurance merely refers to any life insurance policy that does not run out.

Report this page